🧾 Loan Calculator — How Much Will Your Loan Really Cost?

**Note: For exceeding 120 no. of payments, a group of 12 payments will be combined into a single payment number for better chart visibility. The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

Period

Payment

Extra Payment

Interest

Balance

Calculator Disclaimer

A Loan Calculator is one of the most useful financial tools you can use when planning a loan — whether it’s a home loan, personal loan, auto loan, or education loan. It helps you estimate monthly payments (EMI), total interest paid, and the total repayment amount so you can compare lenders, decide loan tenors, and plan your budget.

Below is a detailed, user-friendly guide you can paste into a blog or use on a product page. It includes the formula, worked examples, tips to save interest, and Amazon affiliate product suggestions to help readers manage their finances.

🛒 Amazon Products to Help Manage Loan & Finances

- Financial Calculator (Scientific/Financial functions) — handy for professionals and students doing finance calculations.

👉 Buy on Amazon - Personal Finance Planner / Budget Notebook — track EMIs, payments, prepayments, and savings goals.

👉 See on Amazon - Spreadsheet & Excel Guide Book (for financial modeling) — helps you build amortization schedules and scenario models.

👉 View on Amazon - Portable Scanner or Document Organizer — keep loan documents, bank statements, and receipts organized.

👉 Check Price on Amazon - Calculator Watch / Pocket Calculator — quick on-the-go calculations without opening apps.

👉 Shop on Amazon

🔢 What a Loan Calculator Does

A loan calculator typically requires three inputs:

- Principal (P) — the loan amount you borrow.

- Interest rate — usually annual nominal rate (converted to monthly for calculations).

- Tenure (n) — loan duration, usually in months or years.

From these it computes:

- EMI (Equated Monthly Installment) — monthly payment that includes principal + interest.

- Total payment — EMI × number of months.

- Total interest paid — total payment − principal.

- Optionally: amortization schedule (breakdown of principal vs interest each month).

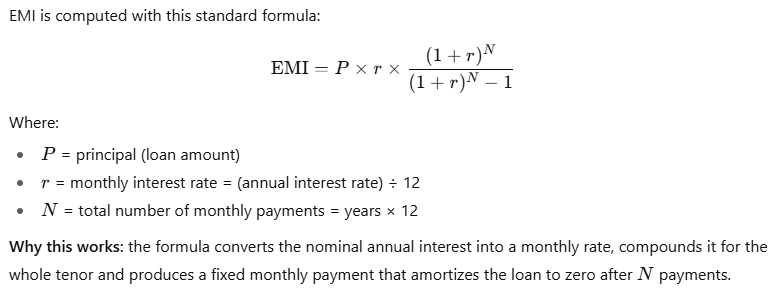

🧮 The EMI Formula (step-by-step)

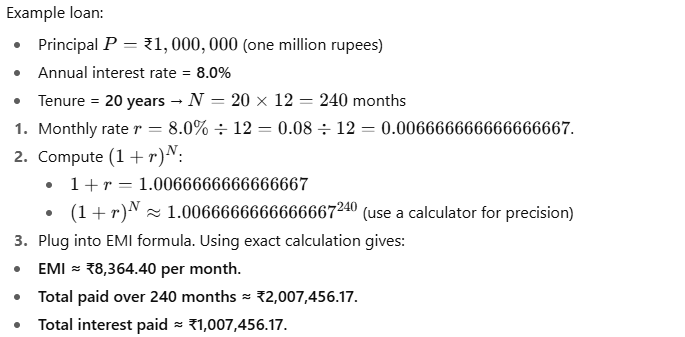

🔍 Worked Example (digit-by-digit accuracy)

So for a ₹1,000,000 loan at 8% for 20 years, you repay roughly ₹2.01 million total — about ₹1.01 million of that is interest.

Tip: even small reductions in interest rate or shorter tenures dramatically reduce total interest paid.

📉 Amortization — Principal vs Interest

In the early EMIs a large share goes toward interest; over time the interest portion falls and the principal portion rises. A loan calculator that shows an amortization schedule helps you:

- See how principal balance declines month-by-month.

- Find the exact interest paid in any year.

- Plan lump-sum prepayments to maximize interest savings.

💡 How to Save on Interest (practical strategies)

- Increase EMI or shorten tenure — paying for fewer months reduces total interest.

- Make occasional lump-sum prepayments — reduces principal and future interest; ask lender about prepayment rules/penalties.

- Refinance when rates drop — switch to a lower-interest loan if fees allow.

- Avoid extending tenure unnecessarily — longer tenures reduce EMI but increase total interest.

- Keep a good credit score — get access to lower interest rates.

🧾 Types of Loans & What Changes in Calculation

- Fixed-rate loans: same nominal rate for the whole tenor → EMI formula above applies directly.

- Floating-rate loans: interest rate can change — calculators can project scenarios (best/worst/certain expected rates).

- Balloon/step-up loans: not constant EMI; require specialized calculators (balloon payment schedule or graduated payments).

- Bullet loans: interest periodically but principal repaid at end — calculator should show lump-sum principal repayment.

✅ What a Good Loan Calculator on Your Site Should Offer

- Inputs: Principal, annual rate, tenure (years/months), start date.

- Advanced options: processing fees, prepayment plans, annual increments, tax benefits (for home loans).

- Output: EMI, total payment, total interest, amortization table (monthly), printable summary, CSV export.

- UX: mobile-friendly, sensible defaults, clear currency formatting, explanatory tooltips.

📊 Example Use Cases

- Homebuyer comparing bank offers.

- Car buyer choosing between 3-year and 5-year loans.

- Small business evaluating a short-term working capital loan.

- Student estimating education loan repayments and monthly budgeting.

❓ Frequently Asked Questions (FAQs)

Q: Can I prepay part of a loan?

A: Most lenders allow partial prepayments but check for prepayment fees, lock-in period, and whether the EMI or tenure will be adjusted.

Q: Should I reduce EMI or tenure on prepayment?

A: Reducing tenure saves more interest overall. Reducing EMI improves monthly cash flow but may cost more in total interest.

Q: Does the EMI formula change if interest rate is annual vs monthly?

A: No — always convert the annual nominal rate into a monthly rate by dividing by 12 before using the EMI formula.

Q: Are processing fees included in EMI calculation?

A: Processing fees are usually a one-time charge. You can add them to principal or treat separately when calculating true loan cost.

🧾 Quick Checklist Before You Apply

- Compare APR (effective annual rate including fees), not just nominal rate.

- Check prepayment rules and foreclosure charges.

- Verify processing fees, insurance, and other charges.

- Keep copies of sanction letters, repayment schedules, and statements.

Final Thoughts

A Loan Calculator is essential for planning loans sensibly. It gives a realistic view of monthly payments and total interest and helps make informed choices about tenures, lenders, and prepayment strategies. Embed a user-friendly calculator on your site with an amortization table and prepayment planner — your readers (and their wallets) will thank you.

📋 All Calculators

- Advance Age Calculator

- Sleep Calculator Pro

- Currency Converter

- Conversion Calculator Premium

- Fuel Cost Calculator

- Loan Calculator

- Compound Interest Calculator

- Pregnancy Calculator

- Ovulation Calculator Pro

- Ideal Weight Calculator

- Daily Calorie Intake Calculator

- BMI (Body Mass Index) Calculator

- Car Payment Calculator

- Percentage Calculator Pro

- Simple Mortgage Calculator

- ROI Calculator

- Tip Calculator

- Discount Calculator