📈 Compound Interest Calculator – Grow Your Money Smarter

When it comes to building wealth, compound interest is your best friend. Unlike simple interest, which only grows on the original principal, compound interest allows your money to grow exponentially by adding earned interest back into your balance. A Compound Interest Calculator helps you quickly estimate how much your investments, savings, or deposits will be worth in the future.

🛒 Recommended Amazon Products for Smart Investing

👉 Financial Calculator for Students & Professionals – Perfect for quick compound interest and EMI calculations.

👉 Rich Dad Poor Dad Book – Learn the mindset and strategies for wealth building.

👉 Budget Planner Notebook – Track savings, investments, and compounding goals.

👉 Excel Finance Guide – Build your own compound interest models.

👉 Personal Finance Organizer – Keep all your investment documents safe.

🔎 What is Compound Interest?

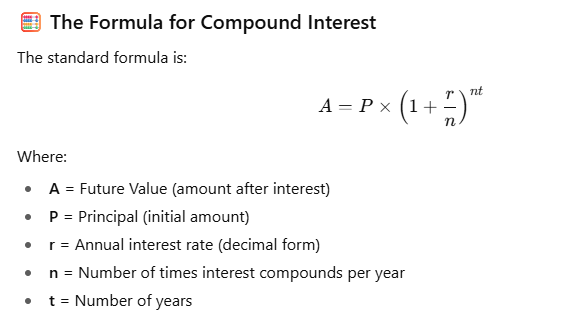

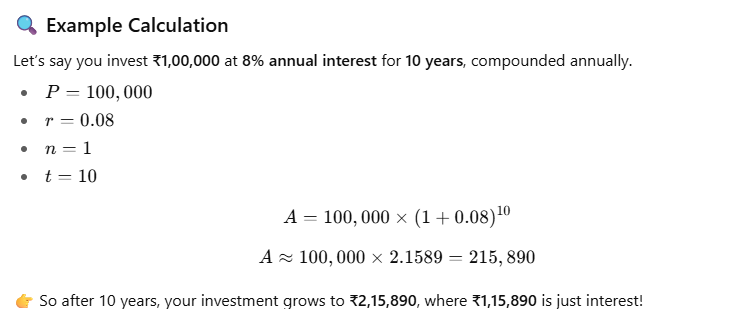

Compound interest means you earn interest on both your initial principal and the accumulated interest from previous periods. This is often called the “power of compounding” because it accelerates growth over time.

The longer you let your money compound, the greater the impact.

📊 Why Use a Compound Interest Calculator?

Doing manual calculations for compound interest can be tedious, especially when interest is compounded quarterly or monthly. A Compound Interest Calculator helps you:

- Quickly estimate future investment value

- Compare different investment options

- Plan savings goals (retirement, education, home purchase)

- Understand the effect of time and compounding frequency

💡 Tips to Maximize Compound Growth

- Start Early – The more time you give your money, the more it compounds.

- Invest Regularly – Add monthly or yearly contributions to boost compounding.

- Reinvest Returns – Always reinvest dividends or interest earned.

- Choose Higher Frequency Compounding – Daily or monthly compounding gives higher returns than annual.

- Avoid Early Withdrawals – Let your investment grow undisturbed.

❓ FAQs

Q: What is the difference between simple and compound interest?

A: Simple interest is calculated only on the principal, while compound interest is calculated on principal + accumulated interest.

Q: Is monthly compounding better than yearly compounding?

A: Yes, more frequent compounding grows money faster because interest is added more often.

Q: Can compound interest work against me?

A: Yes! On loans and credit cards, unpaid interest also compounds, increasing your debt quickly.

✅ Final Thoughts

A Compound Interest Calculator is a must-have tool for anyone planning investments or savings. Whether you’re preparing for retirement, building wealth, or just saving for a big goal, compounding is the magic that multiplies your money. Start early, invest consistently, and let compounding work for you!

📋 All Calculators

- Advance Age Calculator

- Sleep Calculator Pro

- Currency Converter

- Conversion Calculator Premium

- Fuel Cost Calculator

- Loan Calculator

- Compound Interest Calculator

- Pregnancy Calculator

- Ovulation Calculator Pro

- Ideal Weight Calculator

- Daily Calorie Intake Calculator

- BMI (Body Mass Index) Calculator

- Car Payment Calculator

- Percentage Calculator Pro

- Simple Mortgage Calculator

- ROI Calculator

- Tip Calculator

- Discount Calculator